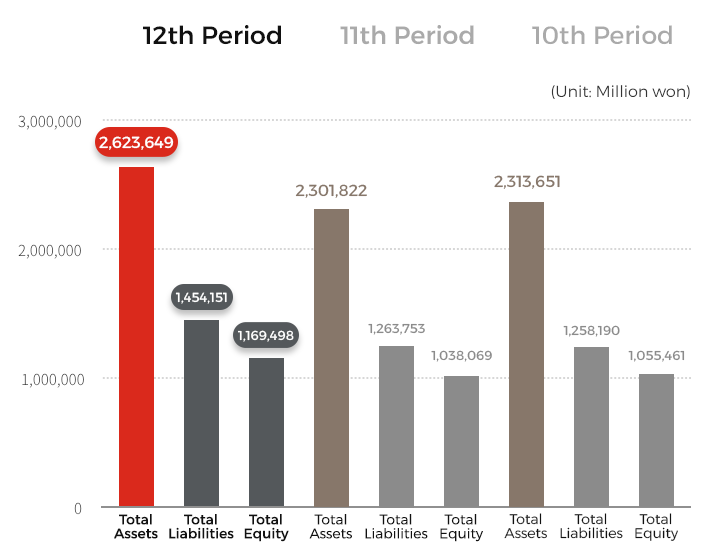

Financial Information

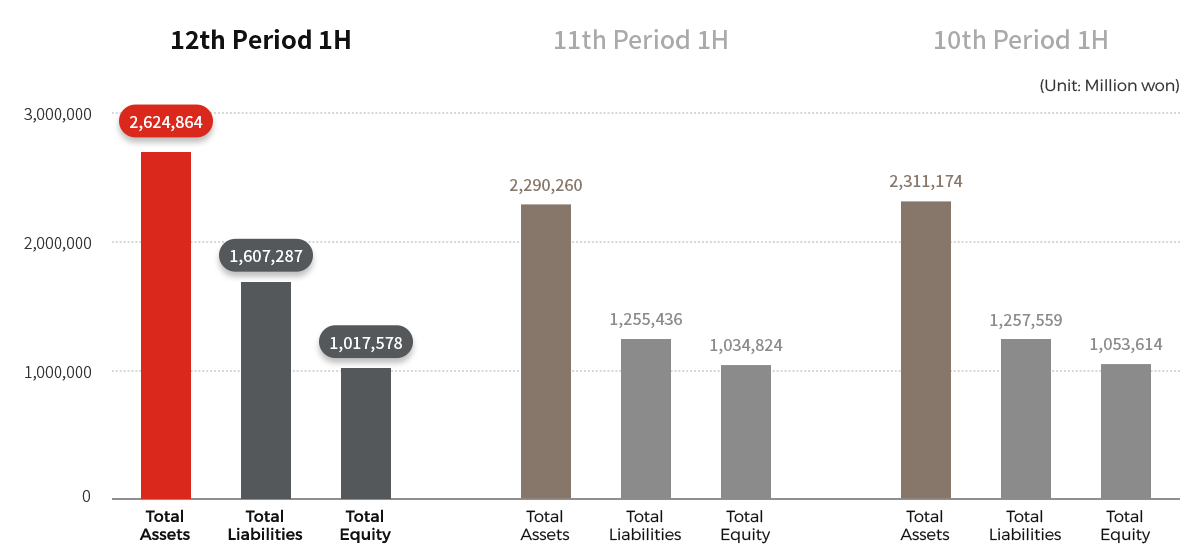

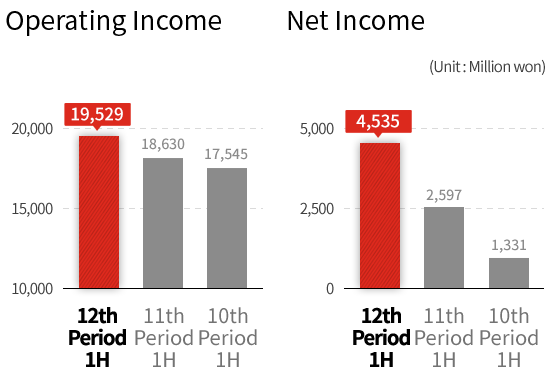

Summary Statement of Financial Position

- Period for the

settlement of account - Half fiscal period for the

settlement of account

(Unit: million won)

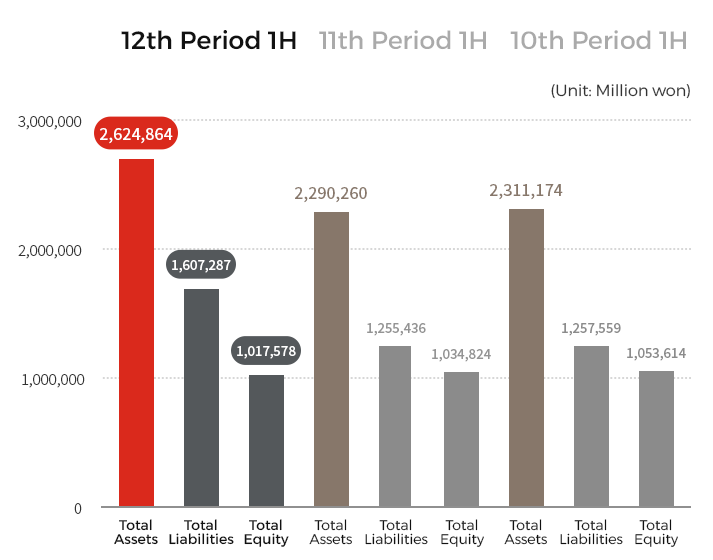

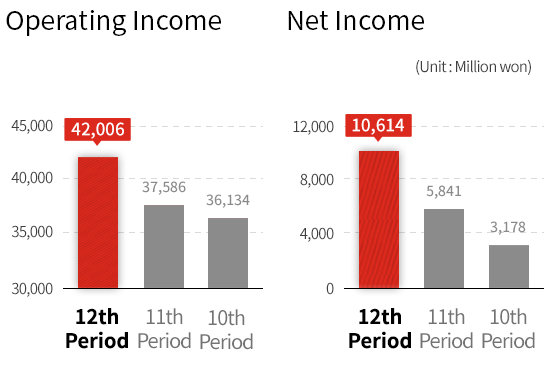

Summary Income Statement

- Period for the

settlement of account - Half fiscal period for the

settlement of account

(Unit: million won)

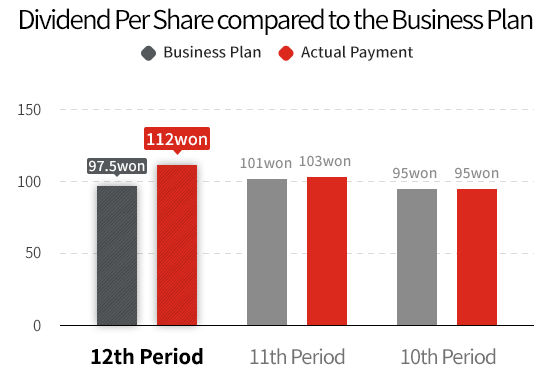

Dividend Information

(Unit: million won)

※ According to Article 28 (3) of the Real Estate Investment Company Act,

a REIT may pay dividends in excess of its profits within the scope of the depreciation

expenses for the relevant year

※ Total dividends incorporate additional paid-in capital transfer

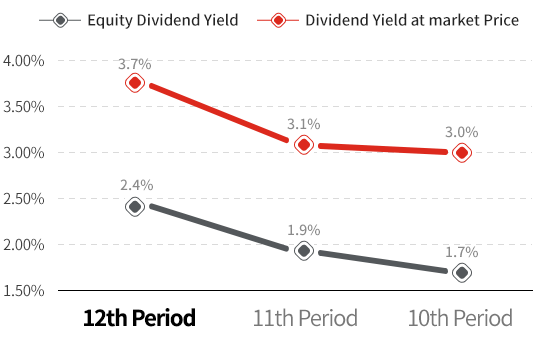

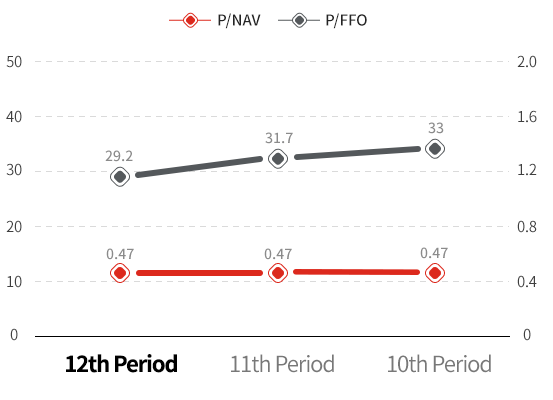

Investment Index

(Unit: %)

※ Equity Dividend Yield: Dividends/Paid-in Capital at the end of each

period

※ Dividend Yield at market price: Dividends/Market Capitalization (based on the closing

price at the end of period)

(Unit: Ratio)

※ P/NAV: Market Capitalization (based on the closing price at the end of

period)/(Appraised Value - Borrowings)

※ P/FFO: Market Capitalization (based on the closing price at the end of period)/(Net Income

+ Depreciation Expenses)